Liverpool freeport that could bring £850m to region has business case approved

and live on Freeview channel 276

Development of a freeport that could bring hundreds of millions of pounds to the Liverpool City Region (LCR) economy has passed one of its final hurdles.

The UK Government has approved the outline business case for the city region’s freeport with a view to a full business case to be submitted later this month. LCR will be home to one of just eight freeports across England.

Advertisement

Hide AdAdvertisement

Hide AdA freeports is a specific geographic area which have different tax and customs rules than the rest of the country.

Should the business case be approved, £25m of funding will be awarded with a summer date expected for it to open for business.

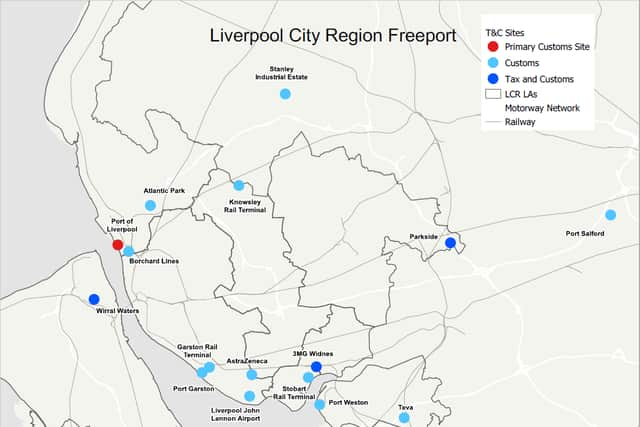

The LCR freeport will be a 45km area stretching from Wirral Waters to the Port Salford.

A range of economic incentives will be available covering customs, business rates, planning, regeneration, innovation and trade and investment support.

Advertisement

Hide AdAdvertisement

Hide Ad

Steve Rotheram, Mayor of the Liverpool City Region said: “The establishment of the Liverpool City Region helps cement our status as a leader in global trade and industry, and will help us attract critical inward investment and create well-paid, highly skilled jobs.

“It is predicted that our Freeport has the potential to add an additional £850 million to the local economy and will help us to build on some of our existing world class strengths. But, for us, it means much more than that.

“Throughout this journey, I’ve asked for guarantees to ensure that we’ll use our Freeport as a force for good, to help build an economy that works for everyone in our region.”

Mr Rotheram said he wanted to attract investors into the region who “believe in and support our local ambitions – those who will help us to protect workers’ rights and uphold standards, and who want to work with us to regenerate and invest in the areas that need it most.”

Advertisement

Hide AdAdvertisement

Hide AdHe said: “Our Freeport will offer lots of opportunities for the Liverpool City Region. It’s my vision to ensure that there is purpose behind that status – that not only drives our economy, but fuels greater social mobility, innovation, and inclusion for our whole region.”

John Lucy, Liverpool City Region freeport director, added: “Having our outline business case accepted is a hugely significant step towards our Freeport becoming operational and attracting businesses to take advantage of the full range of benefits we can offer, which will in turn create thousands of sustainable, high-quality jobs.

“We will attract additional trade through the port of Liverpool but the Freeport will bring benefits for the whole of the Liverpool City Region, extending as it does over a large part of our region with a number of sites offering benefits to businesses.

“There’s a comprehensive measure of packages that includes tax relief and support for customs, business rates, planning, regeneration, R&D and upskilling to name just a few. At the same time, new technologies and sustainable innovations are taking centre stage and providing answers to the challenges that a lot of large, complex companies are facing.”

Advertisement

Hide AdAdvertisement

Hide AdWhat is a Freeport?

Freeports are specific geographic areas which have different tax and customs rules than the rest of the country. They broadly consist of Customs and Tax Zones.

Imports can enter freeport customs zones with simplified customs procedures and do not have payable tariffs. Businesses operating within these designated areas can take advantage from the deferment of tariffs until their products are moved elsewhere, to another part of the country. They can avoid tariffs and full procedures altogether if they bring in goods to manufacture on site before exporting them again to an international market.

Freeport tax zones will benefit from a range of special regulatory and tax benefits. These include enhanced capital allowances, stamp duty and other buildings and land reliefs, employer national insurance contributions relief, business rate relief, and local retention of business rates for local authorities hosting the tax zones. In particular, there is an emphasis through the tax zones on encouraging and supporting businesses that import, process, manufacture, and re-export goods.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.